Every large company today maintains a data warehouse (DWH) system and is hardly able to make correct planning decisions without functioning business intelligence (BI).

Classic BI is in flux, and buzzwords like competitive intelligence, BI agility and self-service BI give the impression that something big is going on.

For us, these subjects are about the completely natural evolution of company BI over time.

With cognitive intelligence (CI), a disruptive technology is at stake, and few firms are focusing on it at the moment.

The term cognitive intelligence implies that self-learning and self-analyzing systems are involved, which receive unstructured information from all channels, process it, reach conclusions, and draw inferences from it.

Cognitive BI (CBI) describes the integration of cognitive systems with company BI. When both of these worlds are combined, then wholly new possibilities arise for a 360° customer profile 360° or a 360° product profile, as well as for many other classic subjects in the BI field such as supply chain management, financial and marketing controlling.

Ultimately, a comprehensive neural product planning will only be possible through CBI.

CBI delivers detailed and accurate answers to the most important business questions. What exactly do customers want, and when? Which products on the market will be in demand in the future (and how must these be designed)? Which opportunities and risks impact business goals?

For instance, some of the opportunities and risks are market impacts from competitor consolidations, raw materials surpluses or shortages, socio-economic impacts, etc., that have an effect on the whole supply chain and thereby impact business objectives.

In order to identify precisely what piece of this constitutes a disruption, it is worth taking a look at the current approach.

A working BI can only be helpful when the correct data are located in the DWH and these have also been correctly interpreted.

For this purpose, companies employ highly specialized and experienced colleagues from the field of IT who work together to identify the data relevant to the business and prepare analyses of them. In some instances, hundreds of data scientists work on new BI analyses in order to obtain even better and informative results.

It is not always clear whether these analyses actually deliver the results that one hopes for. It is not uncommon for new, cumbersome analysis methods to be implemented and then, only later, it is realized that no noteworthy relationships exist.

Here is where Cognitive BI comes in. CBI constantly analyses what motivates the customer segment and the customer market and which correlations are discernable. It uses information from all channels for this. The newest information from the entire internet, such as the patent data bank or the social web, and all discoveries from internal DWH and BI.

The knowledge resulting from this is passed on to the departments and data scientists, who then devise new analytical methods.

The internal BI thereby becomes more effective, faster, more agile and beneficial. Fewer analysts can concentrate in a focused way on the portion of the information that represents the highest probability of added value for the company.

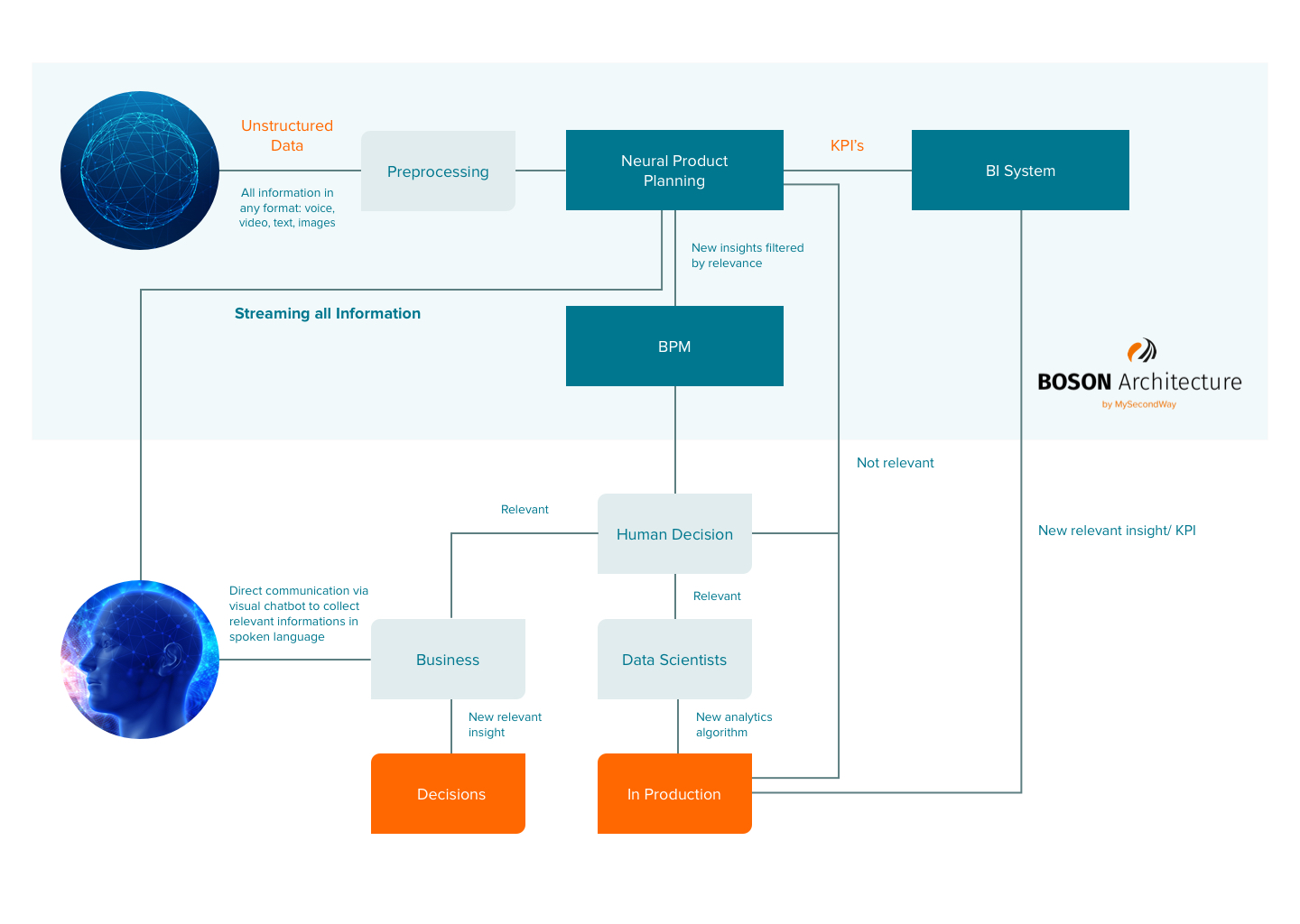

Building on the BOSON architecture, a system develops that operates with self-learning and self-analysis and offers expert users the potential for self-service BI. In this context, self-service BI does not mean a display on a dashboard, but rather the opportunity for each colleague to be able to communicate with the system in a natural way, using speech, over a chat bot. Moreover, the cognitive system continually delivers newly learned findings and relays them to the department for appraisal and further use.

Cognitive BI delivers new insights and provides recommendations for undiscovered correlations that serve the company’s goals. Experts must investigate these recommendations and act accordingly. The result is new analyses that in turn serve as inputs for the CBI. A circuit with constantly changing general requirements and knowledge is thereby developed.

Here, in order to avoid creating expectations that are too high, it must be said that CBI itself does not steer the company analyses; rather, it delivers statements about potentially undiscovered opportunities and correlations to the company experts.

For example, companies have been ascertaining the behavior of their customers with the help of BI for a long time, and can already reach very good conclusions today about how customers react (channel marketing, time spreading, etc.) and allow themselves to be influenced (rebates, gratis products, bundles, etc.).

They obtain this knowledge by identifying, via complex analyses of customer behavior (page impressions, funnels, bounce rates, cross-selling, and much more), various customer clusters that can then be approached with different campaigns. The individual sales approach is relevant because general advertising that approaches all customers in the same way is inefficient and expensive.

Cognitive BI delivers to the internal company experts and analysts statements about where correlations hidden in all of this data are buried and where deeper analyses in the DWH are worthwhile.

What is new and disruptive in this approach is that machines are taking a more precise look at the data from the DWH and relating these to information from chat rooms, websites, communities, patent data banks, articles of competitors and elsewhere. Both external sources and internal databases beyond the central DWH can thereby be used for analysis.

For example, with prevailing BI systems, statements can be made that 35% of the customers who bought Product A also bought Product B, and 20% of them also bought Product C. And 15% of the customers who add Product B to the cart also buy Product D.

This is how a cascade of opportunities that can be offered to customers emerges out of past values.

CBI goes a step further here. It determines not only which trends are currently developing, but also what effects this will have on supplier contracts, supplier processes, fixed reorder cycles or future purchaser behavior.

For instance, if a trend for a new Product Z develops, the system detects from the product data inputs in the DWH that this product has not yet been offered by the company. Using information about the product (product composition on websites, data from patent data banks, etc.), the system simultaneously identifies the dependencies on raw materials or aggregates.

The associated product group and further insights such as the early adopter status of the customers, etc., are identified from the DWH, and calculations regarding the future potential of the new product are carried out.

One outcome could be that in taking up Product Z into the company’s basket of goods, Products B and C offer an improved sales performance. The CBI system will make a statement about this and submit it to the experts as a recommendation.

A decisive competitive advantage!

BI Systems increasingly must be augmented to store aggregated information. Not only the most important aggregate values such as status, early adopter rate, bounce rate, return rate, etc. must be available in the customer profile. Much more information, such as the cross-selling product rate, influencer rate, copycat rate, product category bounce rates, product category sales and a slew of other customer attributes must be detected and saved. These data serve as important input variables for cognitive BI and are essential for analysis.

Analogous needs arise from the perspective of product profile, so that the CBI system can obtain detailed conclusions.

Our overview shows how such a system can be constructed and how it interacts.

Interaction of Neural Product Planning and Cognitive BI

Cognitive BI is evolving, and in 5 years it will deliver to those companies that are already concerning themselves with it today, and preparing their systems for it, a competitive advantage that should not be underestimated.

This means that the most security-conscious firms must also give thought to the fact that both the unforeseeable loads on the system and the quantity of data that is to be processed will hardly be economical to self-manage in the future, and at least one hybrid cloud solution will be needed. An approach for this is illustrated by the integrated hybrid infrastructure (IHI).

In future, only those who are in the position of being able to process multiple petabytes of data in an amount of time that is acceptable for business will be capable of meeting competitive challenges.

From the perspective of technical architecture, the adaption of principles like data locality, auto scaling and the correct data retention infrastructure will decide how successfully one can perform on the market.

Today, new approaches such as the Apache project Kudu are already faster than their RDBMS DWH rivals and will clearly take market shares from them in the medium term. They clearly have an advantage in cost-benefit analyses.

On this subject, Ralph Kimball says in an interview:

The same is true for the subject of artificial intelligence and the cognitive systems arising from it.

In the coming years, cognitive systems will influence our decisions, our business markets and life more than one can presently imagine.

The possibilities and the benefits of cognitive BI are enormous and not yet foreseeable. One thing is certain. CBI and neural product planning will have a strong impact on competitiveness.

The companies that are already dealing with this now and already designing their infrastructure for it will be in a position to adapt to cognitive BI very quickly. And whichever company knows the customers’ needs and demands faster and better will gain market shares for itself.

Cognitive BI is an important component of neural product planning [DE: www.mysecondway.com/Neural-Product-Planing ENG: www.mysecondway.com/en/Neural-Product-Planing] Only those who can put the entire market and its impacts in context will be able to hold their own in competition.

Get in touch or send us an email at contact@MySecondWay.com